|

For some of you, this will mean nothing. You will continue doing business as usual. For others, this may be just the thing you've been waiting to hear. Not many people will put it out there in quite this way.

I listened to a podcast the other day where there was a land investor being interviewed that had become very successful. A key part of his approach was his negotiation strategy, which to me felt very heavy handed and potentially lived on the edge of ethically questionable. It reminded me that in order to create value, you're either going to have to take value such as buying at big discounts, or add value by making physical improvements or in our case, with entitlements like subdivisions, zone changes, etc. But let's be honest, many "investors" are out there creating their profits by buying at the biggest discount they possibly can. But to do that, you either have to be capitalizing on someone's ignorance or their unique life circumstances. Don't get me wrong, I am all for getting a good deal. But at what point does a good deal become a bad deal for the other guy? I acknowledge that every seller is a grown up and capable of making grown up decisions. But does that justify capitalizing on ignorance and circumstance? I think that there are many investors out there that understand this but don't know there are other options or don't know how to go about implementing these strategies as a part of their business. I suggest that everyone learn a new skill that helps you add value rather than extract value and see how that does for you. You may be happier in the end.

0 Comments

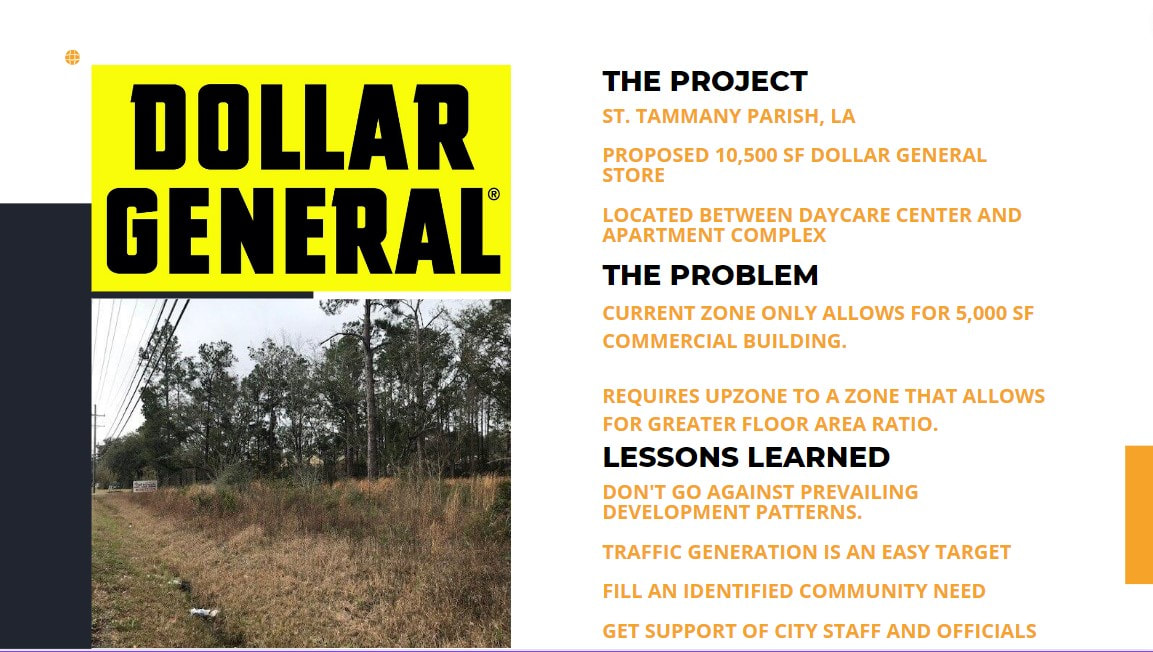

Not all rezoning requests just sail through the approval process. Some of them turn out to be outright disasters. But you can avoid those missteps by learning from the mistakes of others. In St. Tammany Parish, LA, Dollar General was attempting to get a property rezoned because it only allowed for buildings approximately 5,000 sf in size. Rezoning the property would allow them to build a building closer to 10,500 sf in size. This property is located between a daycare center and an apartment complex. In other words, there isn't many commercial uses immediately nearby. That should have been the first red flag. Even though the property was zoned for commercial uses, approval of the request would have doubled the size of the building which would potentially double the impact of the proposed use. Traffic, noise, light spillover and more were all key aspects of the neighborhoods opposition.

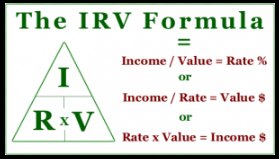

LESSONS LEARNED: Don't go against prevailing development patterns Traffic is always an easy target. Have answers for these complaints Get support of City staff and officials early in the process. Rezoning doesn't have to be controversial. These requests do get approved often. If you want to learn how to put yourself in the path of these deals, set up a quick 15-minute call to see how this unique strategy can fit into your existing business. https://www.tolosapropertygroup.com/free-15-minute-call.html Why do entitlements add so much value to commercial property? It all has to do with this little formula below. Who knew something so simple could be so powerful. If you want to learn more about how entitlements can add massive value to commercial property, you need to check out our upcoming summer seminar series that starts soon. For more details check out our site https://www.tolosapropertygroup.com/education.html

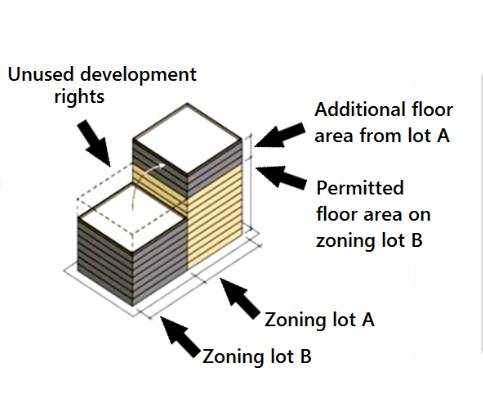

A Transfer of Development Rights Program is a zoning practice that is intended to conserve land by reallocating development from a more dense sending property to a less dense receiving property that may be more suitable for development. Another purpose that the program serves is to allow owners of the sending property to be compensated for the reallocated development rights. Not all jurisdictions have these programs, but you're working in the commercial space, you should take a closer look at the zoning rules to see if this is an option.

We are all looking for ways we may need to shift as the current market evolves. If you're someone that is looking to grow your business in additional or completely new directions then what I have to share may be for you. We all know that entitlements add value especially for developers and builders. What you may not know is that they add value for commercial property investors as well. If learning new ways to add value in the commercial space is of interest to you then I encourage you to check out what we have coming up this summer. This is a 3 part seminar series where we give you the strategies, tactics and tips to help you add value to commercial property with the use of entitlements. This could be something to help diversify your business and insulate you more from the changing markets. Hope to see you there!

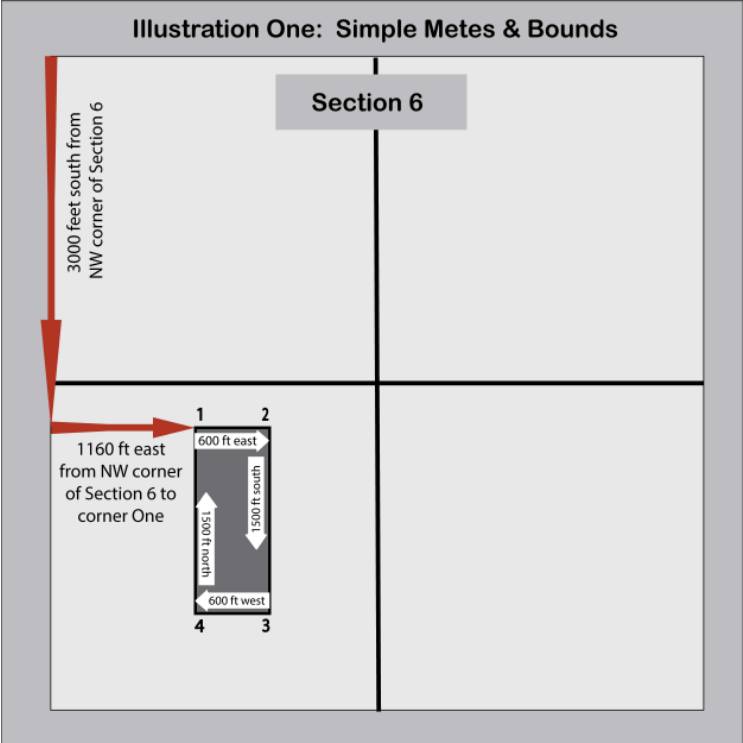

Metes & bounds is the legal description for a piece of land measured in distances, angles, and directions.

Metes is measure. Bounds can be anything, such as a ridge or creek, that limits the parcel of land to be described. This is the way that early settlers would describe their land before a lot and block system was put into place. We've done the leg work for you and create our "State By State Platting Exception List." Visit us here to learn more.

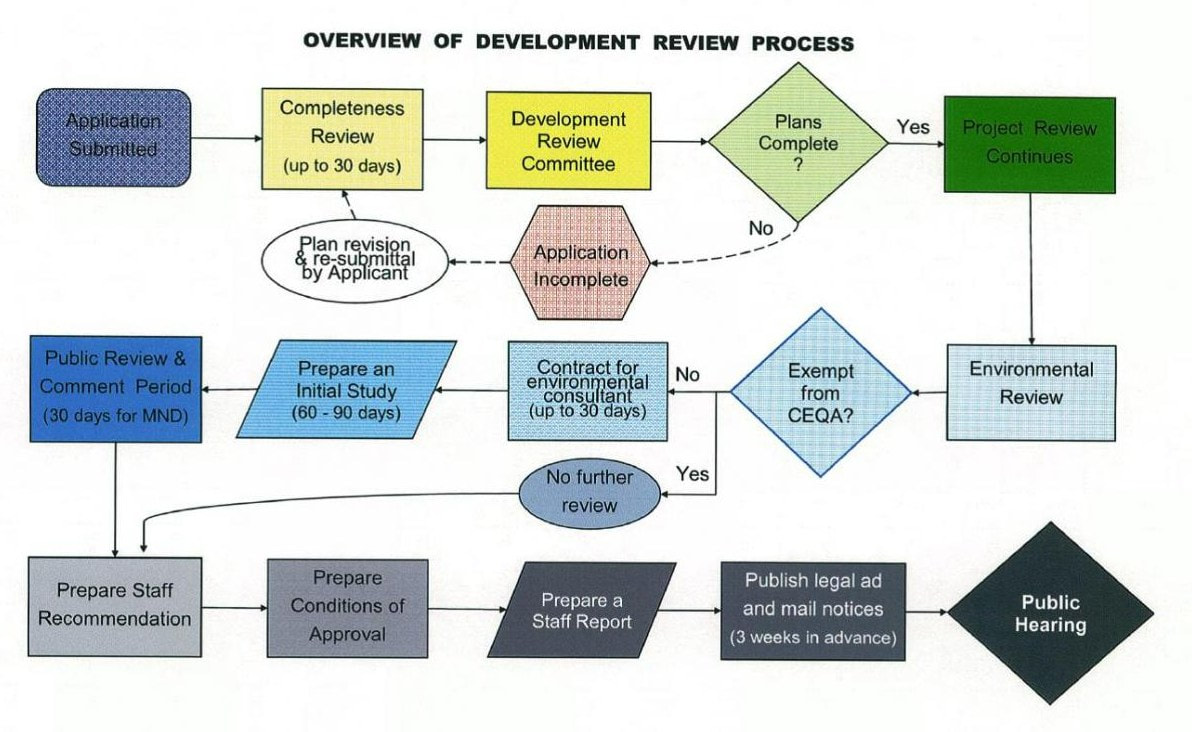

Yes the entitlement process can be complex and lengthy. Although the exact process differs from one area to the next, the image below gives you a good idea of what the process looks like for larger types of projects. Good info to keep in mind!

The value of a property is not just based on its location or what sits on it today. It's also about what could be done to a property in the future. It takes knowledge, vision and determination but with those attributes in hand, you can rezone a property and massively increase its value. No, it's not simple. No it's not easy. But it's the hard that makes it worth it. That, and the returns!

|

Who are we?Our purpose is to inform and advise investors through next level education and services so they can distinguish themselves in their market. Archives

February 2023

Categories

All

|

RSS Feed

RSS Feed